Financial statement auditing service

Auditing financial statements is one of the issues of concern in businesses today

Financial statement auditing is one of the issues of concern for businesses today. CPA HCM provides reputable and quality financial statement auditing services in accordance with the law to increase efficiency. Customer trust helps determine the reliability of the information a business provides to investors, creditors or related parties..

The article below from CPA HCM helps customers understand information surrounding the financial statement audit process as well as our financial statement auditing process! Let's find out.

1. WHAT IS AUDIT OF CORPORATE FINANCIAL STATEMENTS?

1.1. What are business financial statements?

Enterprise financial reports are economic and financial information presented by accountants in the form of tables, providing information about the financial situation, business situation, and cash flows of the enterprise to meet the requirements of the enterprise. requirements for those who use them in making economic decisions.

1.2. What is a financial statement audit?

Financial statement auditing is the examination and confirmation of the accuracy and truthfulness of accounting data, documents and financial reports of accounting units to serve those who need to use them. Use information in a business's financial statements. In particular, the system of accounting and auditing standards is the measure to evaluate the audit of financial statements.

Normally, the work of auditing financial statements will be undertaken by auditing businesses, serving managers, governments, banks, and investors.…

Specifically:

- For managers: Show them the problems and errors being encountered to overcome and improve the quality of the unit's financial information.

- For banks or investors: This work will help investors review their lending based on the actual operating situation of the business.

1.3. Subjects of auditing financial statements

The object of financial statement audit work is financial reports. Including: Balance sheet, income statement, cash flow statement and financial statement notes…

2. ANY COMPANY MUST AUDIT FINANCIAL STATEMENTS?

The legal basis for requiring businesses to have their financial statements audited is Decree No. 17/2012/ND-CP detailing and guiding the implementation of a number of articles of the Law on Auditing. Independence issued on March 13, 2012.

Circular 40/2020/TT-BTC on guidance on reporting regimes in the field of accounting and independent audit in Decree 174/2016/ND-CP guiding the Accounting Law and Decree 17/2012/ND- CP guides the Law on Independent Auditing.

Accordingly, businesses are required to have their financial statements audited, including:

- Enterprises with foreign investment capital.

- Credit institutions established and operating under the Law on Credit Institutions, including foreign bank branches in Vietnam.

- Financial institutions, insurance enterprises, reinsurance enterprises, insurance brokerage enterprises, branches of foreign non-life insurance enterprises.

- Public companies, issuing organizations and securities trading organizations.

- Other businesses and organizations are required to be audited according to relevant laws.

- State-owned enterprises, except state-owned enterprises operating in the field of state secrets as prescribed by law, must have their annual financial statements audited.

- Enterprises and organizations implementing important national projects and group A projects using state capital, except for projects in the field of state secrets as prescribed by law, must be audited for their reports. finalization of completed project.

- Enterprises and organizations in which state-owned corporations and corporations hold 20% or more of voting rights at the end of the fiscal year must be audited for their annual financial statements.

- Enterprises in which listed organizations, issuing organizations and securities trading organizations hold 20% or more of voting rights at the end of the fiscal year must have their annual financial statements audited.

- Auditing firms and branches of foreign auditing firms in Vietnam must be audited for their annual financial statements.

3. PURPOSE AND PRINCIPLES OF FINANCIAL STATEMENT AUDIT

3.1. Purpose of financial statement audit

- General objective: Find evidence to form opinions about the truthfulness and reasonableness of information on financial statements.

- General audit objective: Review and evaluate the overall amount recorded on the cycles, based on a common commitment to the manager's responsibility for the information obtained through actual surveys at the enterprise.

3.2.. Basic principles of financial statement auditing

There are four basic principles that auditors need to follow when auditing financial statements. That is:

- Comply with the law.

- Comply with professional ethical principles such as: independence, integrity, objectivity, professional capacity, prudence, and confidentiality.

- Comply with professional standards.

- Auditors need to have an attitude of professional skepticism.

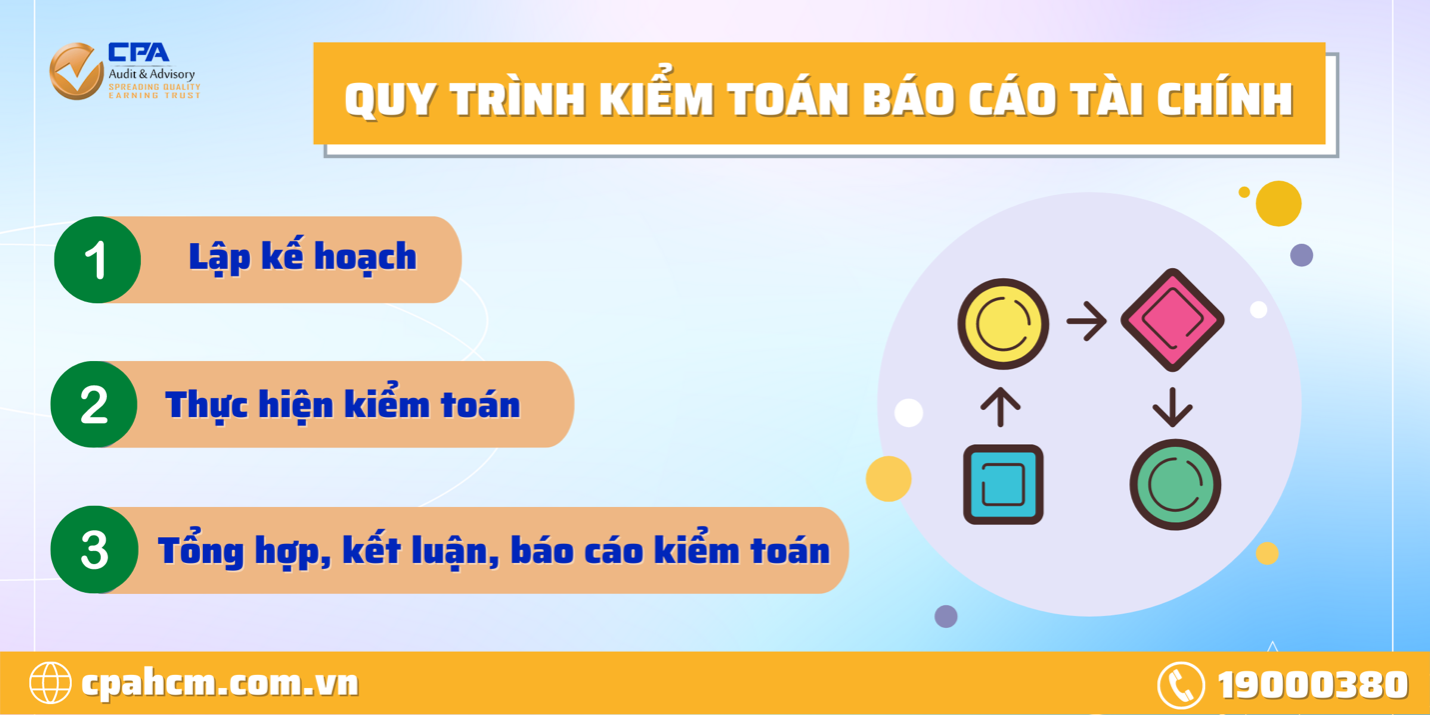

4. FINANCIAL STATEMENT AUDIT PROCESS AT CPA HCM

To collect sufficient information as a basis for conclusions about the integrity of financial statements, auditors need to develop a specific audit process. Normally, this process includes 3 steps as follows:

- Planning.

- Conduct audits.

- Summarize, conclude and form audit opinions.

4.1. Prepare audit plans, risk assessments and assessed risk treatment measures

Auditors and audit firms need to create an audit plan, clearly describing the expected scope and how the audit will be conducted. In addition, the plan needs to be complete and clear to serve as a basis for the audit program.

Starting from the audit invitation letter, the auditor will get to know the customer and evaluate the internal control system. Next, when planning, the audit company also needs to prepare the means and staff to implement the program.

In addition, auditing firms and auditors need to identify and assess the risk of material misstatement due to fraud or error at the financial statement level and assertion level. From there, it is proposed to implement measures to handle the assessed risks.

4.2. Conduct audits

Auditors follow technical methods adapted to each specific subject to collect accurate data. This process is essentially the proactive and active implementation of audit plans and programs to provide opinions on the authenticity and reasonableness of an enterprise's financial statements.

This is the stage where auditors carry out detailed control, analysis, and inspection procedures based on the results of evaluating the client's internal control system.

4.3. Summarize and form audit opinions

After analysis and evaluation, the auditor will make conclusions recorded in the report or audit minutes. Specific tasks that need to be performed before assessment include:

- Consider unexpected debts.

- Consider events that occurred after the end of the period.

- Consider the continuous operation of the unit.

- Collect explanation letter from the Board of Directors (if any).

5. FINANCIAL STATEMENT AUDIT SERVICES AT CPA HCM

CPA HCM financial statement auditing services include:

- Check and review the company's accounting records and books.

- Check and review financial reports.

- Analyze the company's capital fluctuations during the period.

- Send confirmation letters for bank, investment, receivable and payable accounts.

- Observe the performance of the company's main fixed assets and check the reflection of those assets at the balance sheet date.

- Evaluate the correctness of the company's internal control system in managing cash, inventory, and fixed assets to confirm the existence, ownership, and value of cash and fixed assets and inventory at the end of the fiscal year.

- Evaluate the company's internal control system for financial leasing contracts.

- Perform other or alternative audit procedures as necessary on a case-by-case basis.

- Issue audit reports.

- Issuing a management letter (if necessary) addressing shortcomings in the accounting system and internal control system and providing accountants' suggestions to improve this system.

With more than 10 years of operation, CPA HCM has been providing financial statement auditing services for many state-owned economic groups and large enterprises throughout the provinces and cities across the country, helping customers comply with regulatory requirements. policies applied to state-owned enterprises, overcoming existing weaknesses, perfecting the accounting system and internal control system, thereby improving the quality of financial management and business operations.

With our team of independent, competent, experienced and well-trained experts and auditors, we will help your business collect and evaluate audit evidence on financial reports. audited to check and report on the truthfulness, accuracy and reasonableness of the financial statements with established standards and norms.

Customers who are interested in CPA HCM financial statement auditing services or have questions about our working process, please contact us immediately via Hotline: 19000380 to get help from our professional team. The most dedicated advice and support.

Tin cùng chuyên mục

DỊCH VỤ KIỂM TOÁN BÁO CÁO TÀI CHÍNH LÀ GÌ? DOANH NGHIỆP NÀO BẮT BUỘC KIỂM TOÁN?

ĐIỂM MỚI TRONG XỬ PHẠT VI PHẠM THUẾ & HÓA ĐƠN: SO SÁNH NGHỊ ĐỊNH 125 VÀ NGHỊ ĐỊNH 310 (2025)

BỎ THUẾ KHOÁN HỘ KINH DOANH: CHI PHÍ TĂNG HAY GIẢM KHI CHUYỂN SANG KÊ KHAI?

04 CHÍNH SÁCH ƯU ĐÃI DÀNH CHO HỘ KINH DOANH THEO NGHỊ QUYẾT 198/2025/QH15

DỊCH VỤ RÀ SOÁT & QUYẾT TOÁN THUẾ CHO BAN QUẢN TRỊ CHUNG CƯ – CPA HCM

GIẢI PHÁP KẾ TOÁN TRỌN GÓI TỪ CPA HCM GIÚP HỘ KINH DOANH AN TÂM TRƯỚC NGHỊ QUYẾT MỚI

ĐIỀU KIỆN HƯỞNG ƯU ĐÃI THUẾ THU NHẬP DOANH NGHIỆP 2025: DOANH NGHIỆP CẦN LƯU Ý GÌ?

TRẢI NGHIỆM ĐỊNH HƯỚNG NGHỀ NGHIỆP: Sinh Viên Văn Hiến "Thực Chiến" Cùng CPA HCM