WHEN IS IT REQUIRED TO USE ELECTRONIC INVOICES IS November 1, 2020 OR July 1, 2022???

Delay the mandatory deadline for using electronic invoices until July 1, 2022?

Delay the mandatory deadline for using electronic invoices until July 1, 2022?

Previously, according to Clause 2, Article 35 of Decree 119/2018/ND-CP on electronic invoices, it was stipulated: The organization of implementation of electronic invoices and electronic invoices with tax authority codes according to the provisions of the Decree 119/2018 will be completed for businesses, economic organizations, other organizations, business households and individuals no later than November 1, 2020.

However, recently, the National Assembly passed the Tax Administration Law on June 13, 2019. Clause 2, Article 151 clearly states:

– Regulations on electronic invoices and documents of the Tax Administration Law take effect from July 1, 2022;

– Encourage agencies, organizations and individuals to apply regulations on electronic invoices and documents of the Law on Tax Administration before July 1, 2022.

Therefore, many people wonder about when to use electronic invoices.

However, the Law on Tax Administration 2019 only regulates the concept of electronic invoices; principles of creating, managing and using electronic invoices; Apply electronic invoices when selling goods and providing services; Electronic invoice services, electronic invoice services without stipulating the time of registration for application and creation of electronic invoices. Therefore, the time to apply electronic invoices is according to the provisions of Decree 119/2018/ND-CP and its implementation guidance documents, specifically:

* Time to register for electronic invoice application

According to Clause 3, Article 26 of Circular 68/2019/TT-BTC, from November 1, 2020, businesses, economic organizations, other organizations, business households and individuals must register to apply electricity bills. death.

* Required time to use electronic invoices

Enterprises, economic organizations, other organizations, business households and individuals are required to use electronic invoices from November 1, 2020..

Source: tintucketoan.com

Tin cùng chuyên mục

BẠN MỞ CÔNG TY ĐỂ KINH DOANH, HAY ĐỂ ĐAU ĐẦU VÌ KẾ TOÁN?

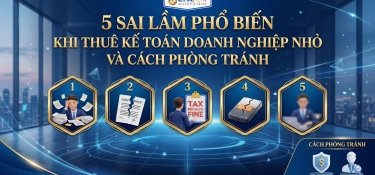

5 SAI LẦM PHỔ BIẾN KHI THUÊ KẾ TOÁN DOANH NGHIỆP NHỎ VÀ CÁCH PHÒNG TRÁNH

Cập nhật chính sách Thuế mới ảnh hưởng đến doanh nghiệp Năm 2026

DỊCH VỤ KIỂM TOÁN BÁO CÁO TÀI CHÍNH LÀ GÌ? DOANH NGHIỆP NÀO BẮT BUỘC KIỂM TOÁN?

ĐIỂM MỚI TRONG XỬ PHẠT VI PHẠM THUẾ & HÓA ĐƠN: SO SÁNH NGHỊ ĐỊNH 125 VÀ NGHỊ ĐỊNH 310 (2025)

BỎ THUẾ KHOÁN HỘ KINH DOANH: CHI PHÍ TĂNG HAY GIẢM KHI CHUYỂN SANG KÊ KHAI?

04 CHÍNH SÁCH ƯU ĐÃI DÀNH CHO HỘ KINH DOANH THEO NGHỊ QUYẾT 198/2025/QH15

DỊCH VỤ RÀ SOÁT & QUYẾT TOÁN THUẾ CHO BAN QUẢN TRỊ CHUNG CƯ – CPA HCM