Process for processing requests for extension of tax payment and land rent payment in 2021

To support taxpayers who request to extend tax payment and land rent payment in 2021 in accordance with the provisions of Decree No. 52/2021/ND-CP, the General Department of Taxation has just issued a document guiding tax authorities at all levels. Process for processing taxpayer extension requests.

According to the General Department of Taxation, based on the information on the taxpayer's request for extension that has been updated according to the instructions of the Tax authority, the Centralized Tax Management Application System (TMS) will process as follows:

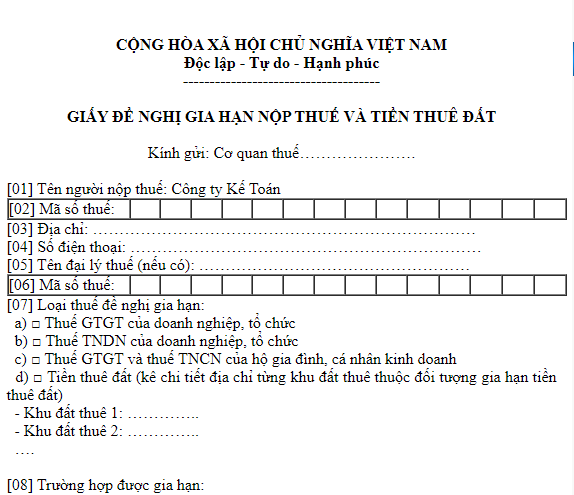

For requests for extension of value-added tax (VAT) payment: The TMS system automatically updates the extended tax payment deadline for the arising VAT payable of the tax period of March, April, and December. 5, June, July, August 2021 and the tax period of the first quarter, second quarter of 2021 according to Form 01/GTGT, 03/GTGT, 04/GTGT, 05/GTGT (including official declaration and added during the extended period).

For the VAT amount extended according to appendix Form 01-6/GTGT, the tax declaration and accounting department of the tax agency managing the allocated VAT amount will look up the list of proposed taxpayers. extension on the TMS system to control and update the extended tax payment deadline.

For requests for extension of corporate income tax (CIT) payment: Taxpayers self-determine the tax amount that must be temporarily paid in the first and second quarters of the 2021 corporate income tax period and based on the extended deadline as prescribed in Clause 1 of this Article. Clause 2, Article 3 of Decree No. 52/2021/ND-CP to pay money into the state budget.

For requests to extend payment of VAT and personal income tax (PIT) of households and individual businesses: The TMS system automatically updates the extended tax payment deadline for VAT and PIT amounts. arising payable in 2021 of households and individual businesses.

For the request to extend land rent payment: The taxpayer has accurately declared the notice number information; At the same time, the tax authority issued a land rent notice on the Extension Application and the tax authority fully updated the corresponding land rent notice number information on the TMS system. The TMS system will support automatic updating of land rent payment extension information according to each Notice for the land rent payable in the first period of 2021 as prescribed in Clause 4, Article 3 of Decree No. 52/2021/ND -CP.

In case the TMS system does not have enough information to support automatic updating, the tax authority managing land rent collections will look up the list of taxpayers requesting extension on TMS to review and update the information. Extension of land rent payment according to the Notice for land rent payable in the first period of 2021.

The General Department of Taxation also notes that in cases where the extension request is sent after the tax authority closes the monthly tax accounting book, the tax authority will manually update the extended payment deadline for the extended tax amount. In the period that has been closed, the TMS system automatically updates the payment deadline for the tax payable in the next extended tax periods. Tax authorities make adjustments to previously calculated late payment interest (if any).

In case during the extension period, the tax authority has a basis to determine that the taxpayer is not subject to the extension, the tax authority shall issue a notice to the taxpayer about stopping the extension according to the form prescribed by the General Department of Taxation. ; At the same time, require taxpayers to pay the full amount of tax, land rent and late payment interest during the extended period to the state budget.

After the extension period expires, through inspection and testing it is discovered that the taxpayer is not eligible for an extension to pay taxes and land rent according to regulations, the tax authority requires the taxpayer to pay the remaining tax amount. deficiency, fines and late payment interest are determined back into the state budget.

Tin cùng chuyên mục

TỔNG HỢP GIẢI ĐÁP CHI PHÍ TIỀN LƯƠNG THEO NGHỊ ĐỊNH 320/2025/NĐ-CP & LUẬT BHXH 2024

NHỮNG ĐIỀU CẦN LÀM SAU KHI THÀNH LẬP DOANH NGHIỆP NĂM 2026

BẠN MỞ CÔNG TY ĐỂ KINH DOANH, HAY ĐỂ ĐAU ĐẦU VÌ KẾ TOÁN?

5 SAI LẦM PHỔ BIẾN KHI THUÊ KẾ TOÁN DOANH NGHIỆP NHỎ VÀ CÁCH PHÒNG TRÁNH

Cập nhật chính sách Thuế mới ảnh hưởng đến doanh nghiệp Năm 2026

DỊCH VỤ KIỂM TOÁN BÁO CÁO TÀI CHÍNH LÀ GÌ? DOANH NGHIỆP NÀO BẮT BUỘC KIỂM TOÁN?

ĐIỂM MỚI TRONG XỬ PHẠT VI PHẠM THUẾ & HÓA ĐƠN: SO SÁNH NGHỊ ĐỊNH 125 VÀ NGHỊ ĐỊNH 310 (2025)

BỎ THUẾ KHOÁN HỘ KINH DOANH: CHI PHÍ TĂNG HAY GIẢM KHI CHUYỂN SANG KÊ KHAI?

04 CHÍNH SÁCH ƯU ĐÃI DÀNH CHO HỘ KINH DOANH THEO NGHỊ QUYẾT 198/2025/QH15