Last days of export incentives

Last days of export incentives

More than ten years ago, to attract foreign investment and promote exports, the Government issued Article 19 - Decree 36 (April 24, 1997) on regulations for industrial parks, export processing zones, High-tech Zone.

"Huge" incentive level.

More than ten years ago, to attract foreign investment and promote exports, the Government issued Article 19 - Decree 36 (April 24, 1997) on regulations for industrial parks, export processing zones, High-tech Zone. According to this decree “For export processing enterprises:

10% of profits earned and profit tax exemption for 4 years from the start of profitable business for manufacturing enterprises;

15% of profits earned and profit tax exemption for 2 years from the start of profitable business for service businesses.

For industrial park enterprises:

15% of profits earned for businesses that export less than 50% of their products and are exempt from profit tax for 2 years from the start of profitable business; In case you export from 50% to 80% of your products, you will receive an additional 50% reduction in profit tax for the next 2 years; 10% of profits earned for businesses that export more than 80% of their products and are exempt from profit tax for 2 years and 50% reduction for the next 2 years from the start of profitable business.

20% of profits earned for service businesses and exempt from profit tax for 1 year from the start of a profitable business.

For Industrial Park Infrastructure Development Companies: 10% of profits earned and profit tax exemption for 4 years from the start of profitable business and a 50% reduction for the next 4 years.

In addition: Enterprises investing in export processing zones or industrial parks that export more than 80% of their products will enjoy a corporate income tax rate of 10% throughout the project implementation period (with up to 50 years).

For example, a textile enterprise A established in 1998, located in an industrial park in Ho Chi Minh City, has 1,000 workers, exports over 80% of its products... can enjoy a tax rate of 10% until the year 2048. This incentive level can be considered "ceiling" compared to other incentives.

Adjustment:

Later, the incentives for export rates were gradually "squeezed". By 2003, according to Decree 164 (2003) guiding corporate income tax, production and business projects with an export rate of over 50% of products were only given incentives at a tax rate of 20%. % in the first ten years. Thus, enterprise B established in 2004 and meets the export conditions will enjoy a tax rate of 20% until 2014. However, businesses established before that and enjoying incentives under the old regulations will still continue to enjoy the tax rate. enjoy the old incentives without being reduced.

According to its commitment to join the WTO, Vietnam is required to eliminate all forms of direct incentives and supports in exports but can flexibly apply permitted types of incentives and subsidies.

By 2007, when Vietnam joined the WTO, the above incentives were no longer appropriate. The above incentives are considered subsidies for exports and are eliminated according to accession commitments. Therefore, Decree 24 (2007) guiding corporate income tax has cut off the above incentives for textile and garment enterprises and only allows businesses to enjoy the above incentives until the end of 2011.

In addition to incentives on export rates, incentives due to meeting conditions on domestic raw material use are also eliminated. Previously, businesses in industrial parks only exported about 30% but used many domestic raw materials and supplies, but still enjoyed preferential tax rates of 15%.

However, businesses currently enjoying the above incentives are not necessarily empty-handed, specifically according to Official Dispatch No. 2348/BTC-TCT dated March 3, 2009. According to this official dispatch, there are instructions:

Enterprises operating in the textile and garment sector are entitled to incentives for using domestic raw materials if they meet other preferential conditions on corporate income tax (in addition to preferential conditions for meeting tax conditions). export ratio, due to the use of domestic raw materials) such as: production in industrial parks, production in export processing zones, if the conditions on export ratio are terminated, the export processing zone will switch to enjoy the same conditions as industrial zones (according to Clause 2, Article 2 of Decree No. 29/2008/ND-CP dated March 14, 2008 of the Government); implemented in areas with difficult and especially difficult socio-economic conditions on the List of investment incentive areas; employing many workers... will continue to enjoy corporate income tax incentives corresponding to the conditions the enterprise has met for the remaining incentive period. Businesses are allowed to choose one of the following two options:

Option 1: Continue to enjoy corporate income tax incentives corresponding to the conditions met by the enterprise (in addition to preferential conditions due to meeting the conditions on export rate and using domestic raw materials) for the remaining incentive period as prescribed in previous legal documents on corporate income tax at the time of issuance of the Establishment License.

Option 2: Continue to enjoy corporate income tax incentives corresponding to the conditions met by the enterprise (in addition to preferential conditions due to meeting the conditions on export rate and using domestic raw materials) for the remaining preferential period as prescribed in previous legal documents on corporate income tax at the time of adjustment due to WTO commitments (January 11, 2007).

Thus, businesses operating in the textile and garment sector are entitled to incentives for using domestic raw materials if they meet other preferential conditions on corporate income tax (in addition to preferential conditions for meeting the conditions of corporate income tax). (due to the use of domestic raw materials) can choose one of the two options mentioned above to enjoy corporate income tax incentives for the remaining incentive period as prescribed in legal documents. Previously on corporate income tax at the time of first issuance of the Establishment License or at the time of adjustment due to WTO commitments (January 11, 2007).

Example 1: An export processing enterprise, operating in the field of export garment production, has a project implemented in an Industrial Park. Enterprises established in 1997, according to the investment license, are subject to a corporate income tax rate of 10% throughout the project; Tax exemption for 4 years from the date of taxable income and 50% tax reduction for the next 4 years. Enterprises have taxable income since 1997.

– According to the provisions of the above Investment License: Enterprises are exempted from tax for 4 years (from 1997 to 2000), reduced by 50% for the next 4 years (2001 to 2004), and are entitled to a tax rate of 10% from 1997 to 2000. 1997 until the end of the project's operation period.

– According to the provisions of Decree No. 152/2004/ND-CP dated August 6, 2004, export processing enterprises in the manufacturing sector are transferred to 4-year tax exemption (from 1997 to 2000) and 50% tax reduction. The following year (from 2001 to 2007), a tax rate of 10% applies.

– According to the provisions of Decree No. 24/2007/ND-CP and Circular No. 134/2007/TT-BTC, from 2007, the Company will not enjoy the preferential corporate income tax rate of 10% under export conditions. and tax reduction in 2007. However, the Company meets the conditions for production facilities in the Industrial Park.

Option 1: If it is determined to enjoy incentives according to corporate income tax regulations at the time of issuance of the Establishment License for the remaining incentive period (legal documents at the time of license issuance). 1997, Decree No. 36/CP dated April 24, 1997), then: The company is a production facility in an Industrial Park and is entitled to a preferential tax rate of 15% profit tax (CIT) for the entire operating period. of project; Exemption from corporate income tax for 2 years from the date of taxable income, no tax reduction. By January 11, 2007 (WTO commitment date), the Company had 4 years of tax exemption and 6 years of tax reduction, so if it chooses option 1, the Company will be able to switch to enjoying the 15% tax rate for the remaining time. from 2007 until the end of the project's operation period.

Option 2: If determined to enjoy incentives according to regulations on corporate income tax at the time of adjustment due to WTO commitments (January 11, 2007) for the remaining incentive period (normative document The law at the time of the WTO commitment is Decree No. 24/2007/ND-CP), then: The company is a production facility in an Industrial Park that is entitled to a preferential CIT rate of 15% for 12 years from starting a business; Exemption from corporate income tax for 3 years from the date of taxable income, and a 50% reduction in tax payable for the next 7 years. As of January 11, 2007, the Company was exempted from tax for 4 years and reduced by 50% for the next 6 years (from 1997 - 2006), so the company was not allowed to continue to reduce taxes for the remaining time. The corporate income tax rate of 15% is applied for 12 years (from 1997 to 2008). Thus, if you choose option 2, the Company will be applied a tax rate of 15% for the remaining period of 2007 and 2008, from 2009 it will switch to applying a tax rate of 25%.

Example 2: Company B, located at the Industrial Park address, is a 100% foreign-owned enterprise, with the function of producing over 80% of garments for export, established under an Investment License, 2003 is the starting year. going into production and business. The company enjoys a preferential corporate income tax rate of 10% for the entire operation period of the project, corporate income tax exemption for 4 years from the time the business becomes profitable, and a 50% reduction for the next 4 years. 2005 was the first year the company had income.

– According to the provisions of the above Investment License: The Company is exempted from tax for 4 years (from 2005 to 2008), reduced by 50% for the next 4 years (2009 to 2012), and is subject to a tax rate of 10%. from 2003 until the end of the project's operation period.

– According to the provisions of Decree No. 24/2007/ND-CP and Circular No. 134/2007/TT-BTC, from 2007, the Company will not enjoy the 10% corporate income tax rate and will not be entitled to tax exemption or reduction according to Article 1 of this Article. export case. However, the Company meets the conditions for production facilities in the Industrial Park.

So in this case, Company B will be able to choose 1 of 2 options according to the instructions in Official Dispatch No. 2348/BTC-TCT as follows:

Option 1: If it is determined to enjoy incentives according to corporate income tax regulations at the time of issuance of the Establishment License for the remaining incentive period (legal documents at the time of license issuance). 2003 is Decree No. 27/2003/ND-CP), then: The company is a production facility in an Industrial Park and is entitled to a preferential CIT rate of 15% for the entire operating period of the project; Exemption from corporate income tax for 2 years from the date of taxable income, no tax reduction. Thus, if you choose option 1, the Company will be exempt from tax for 2 years (2005, 2006), and enjoy a tax rate of 15% for the remaining time from 2007 until the end of the project's operation period.

Option 2: If determined to enjoy incentives according to regulations on corporate income tax at the time of adjustment due to WTO commitments (January 11, 2007) for the remaining incentive period (normative document The law at the time of the WTO commitment is Decree No. 24/2007/ND-CP), then: The company is a production facility in an Industrial Park that is entitled to a preferential CIT rate of 15% for 12 years from starting a business; Exemption from corporate income tax for 3 years from the date of taxable income, and a 50% reduction in tax payable for the next 7 years. Thus, if you choose option 2, the Company will have taxable income from 2005. By January 11, 2007, the Company will be exempted from tax for another year (2007), with a 50% reduction for the next 7 years. (from 2008 to 2014), a tax rate of 15% is applied for a period of 12 years (from 2002 to 2013), so by 2007 the company is applying a tax rate for the remaining 7 years. (from 2007 to 2013), from 2014, the corporate income tax rate of 25% applies.

Example 3: A textile enterprise with a project implemented in an Industrial Park, established in 2000, has an export rate of over 80% of its products, so the corporate income tax rate of 10% is applied throughout the project; Tax exemption for 4 years from the date of taxable income and 50% tax reduction for the next 4 years.

According to the provisions of Decree No. 24/2007/ND-CP and Circular No. 134/2007/TT-BTC, from 2007, the Company will not enjoy the 10% corporate income tax rate and will not be entitled to tax exemption or reduction according to Article 1 of this Article. export case. However, the Company meets the conditions for production facilities in the Industrial Park.

According to the example above, if by the time of termination of incentives according to WTO commitments, the enterprise has been exempt from tax for 4 years but chooses option 2 (tax exemption for 3 years and 50% reduction for the next 7 years; apply tax rate of 15% for 12 years from the start of business operations), the enterprise is not allowed to switch to tax exemption conditions according to Decree 24/2007/ND-CP and can only choose to enjoy the tax rate of 15% for 12 years. years from the commencement of business operations for the remaining incentive period.

In case the enterprise has difficulty determining the next incentive plan, it can "confirm investment incentives" based on point 3, official dispatch 2348/BTC-TCT: "According to the provisions of Clause 1, Article 38 of the Investment Law, investors base on the incentive levels and investment incentive conditions prescribed by law to determine the incentive level and carry out procedures to enjoy investment incentives at the competent authority. authorization. In case the investor requests confirmation of investment incentives, he or she must carry out investment registration procedures so that the State agency in charge of investment can record the investment incentives in the Investment Certificate, conversely if the investor If there is no request to confirm investment incentives, there is no need to carry out procedures to adjust the Investment License.”

______Ho Chi Minh City July 27, 2011_ Compiled and analyzed by DTVinh___

Tin cùng chuyên mục

FOR THE FIRST TIME SIU STUDENTS LEARN FORMAL ACCOUNTING PRACTICE IN A BUSINESS ENVIRONMENT

ANNOUNCEMENT OF CHANGE IN COMPANY BRAND

“THE ROAD TRAVELLED, THE EXPERIENCE GAINED” - FAREWELL THE PROFESSIONAL ACCOUNTING COURSE 002 WITH A SMILE AND KNOWLEDGE

THE ATTENTION THINGS BEFORE ESTABLISHING A BUSINESS

RISK WHEN CHOOSING A UNIT THAT PROVIDES UNQUALITY BUSINESS ESTABLISHMENT SERVICES!!

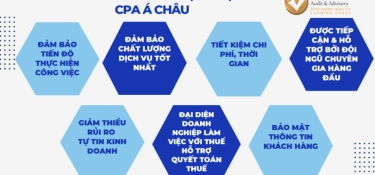

ESTABLISHING A BUSINESS AT CPA HCM

FULL ACCOUNTING PACKAGE CPA HCM - THE DIFFERENCE THAT CREATES THE BRAND.

IMPORTANCE OF MANAGEMENT ACCOUNTING IN BUSINESSES.

CORPORATE ACCOUNTING SERVICES

DEVELOP YOUR CAREER WITH CPA HCM WITH THE COURSE “GENERAL ACCOUNTING”